Editors Note: Kaliah Ligon leads Forward Cities' on the ground entrepreneurial ecosystem building efforts as the Local Director for Indianapolis, IN. This article is part of a broader series designed to highlight the journeys of entrepreneurs and the community-based approach of our Community Entrepreneur Accelerators.

The activity at 3802 North Illinois St. stirred up quite a bit of curiosity from folks in the neighborhood. Sitting at the dividing line of the Crown Hill and Butler Tarkington neighborhoods, the decades-old building had recently been vacated by Under the Sun Market. The space predominantly served in a retail capacity – drug store, shoe store, discount grocery store, and a few other things in between; this time around the Kheprw Institute (KI) (pronounced K-hep-pra) planned to repurpose it for community wealth building as the Alkhemy Business Incubator.

You may be wondering: what is community wealth building, and how does it fit with entrepreneurship? KI defines community wealth as “the collective assets – social, intellectual, cultural, financial, etc. – that a community owns or controls that enable the community to care for one another and the natural environment.” Entrepreneurs have the power to generate this community wealth and the community can help to drive the recirculation of that wealth in their neighborhoods.

Forward Cities, through its Community Entrepreneurship Accelerator (CEA) initiative in Indianapolis, convened an Inclusive Innovation Council, a diverse group of entrepreneur ecosystem builders, to guide the work in the community. This council helped to plan and promote events and connect with entrepreneurs. They reviewed and selected the pilot projects that they felt would have the greatest impact in a short period of time. The Kheprw Institute, represented by Imhotep Adisa, is a member of the Inclusive Innovation Council.

A few dozen Indianapolis entrepreneurs participated in the May 2019 Entrepreneur Assembly which surfaced several potential solutions to entrepreneurs’ barriers. One of the ideas generated was a coworking space that provided back-office support, access to resources, and a welcoming environment close to our focus neighborhoods. The Innovation Council and a working group further refined the idea and considered potential outcomes. From there a Request for Proposals was initiated to identify a consultant to operationalize the coworking space pilot project. A small committee of Inclusive Innovation Council members reviewed the top proposals and selected the Kheprw Institute.

The Kheprw Institute’s community wealth building ideology provided the solution to Forward Cities’ problem statement: “(Black and brown) entrepreneurs lack an entrepreneurial environment that includes culturally appropriate as well as sufficient investment of/access to social, intellectual, financial capital in launching and sustaining a new/ small business.” Among nearly a dozen proposals, Kheprw Institute’s was selected to serve as the consultant to test the demand for a culturally affirming coworking space, named the Entrepreneur Hub. As the Local Director, I developed site selection criteria and worked closely with Diop Adisa from Kheprw Institute and consultant Malieka Robinson of Eastside Collaborative to narrow down the potential sites.

Through leveraging the support of local businesses, community members, and artists Forward Cities and Kheprw Institute embarked on this pilot project with robust community support. The KI Nu Media team generated buzz for the Entrepreneur Hub with posters, digital flyers, business cards, and word of mouth. Participants were asked to pre-register for a free membership. Nearly 160 people pre-registered! Local entrepreneur Dave Sicklesteel of RDS Furniture provided aesthetically pleasing and functional seats. Robin Lee of Nexus Impact Center donated nearly a dozen tables! Local contractors were hired to paint and do electrical and construction. And the cherry on top was talented artists Omar Rashan and Gary Gee curating original art pieces to give the space new life. You would not have known that it was a grocery store just a few weeks prior. On the night of the opening reception well over 100 people were in attendance all brimming with excitement about the vibe and the promise that the space held for community entrepreneurs.

The Entrepreneur Hub was successful in reaching the target outcome to provide access to basic supplies such as on-site printing and technology while creating a socially and culturally safe work environment. The majority of participants reported that they had the opportunity to connect with other aspiring or existing entrepreneurs, they were aware of resources available to meet their needs, and they would recommend a coworking space like this to their friends or family interested in starting a business.

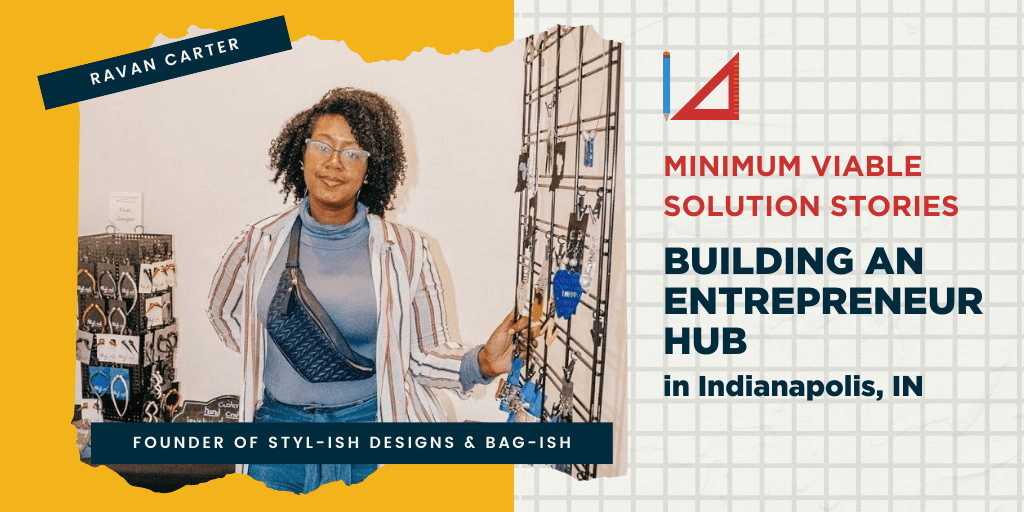

Ravan Carter

Local entrepreneur Ravan Carter became a member of the Entrepreneur Hub and attended several workshops to gain more knowledge as she continues to build her empire. Ravan is the owner of Styl-ish, Bag-ish, and co-owns Self-ish View with her sister. And she has plans to start another venture soon. Seemingly quiet and reserved she may surprise you when you connect with her one-on-one. She is full of ideas and drive! Enjoy the latest episode of Forging Forward featuring multiple business founder Ravan.

A large part of the success of the Entrepreneur Hub were the workshops. Lead consultant Diop Adisa and I created Workshop Wednesdays. We offered lunch-and-learns and afternoon and evening workshops to accommodate entrepreneurs' busy schedules. The workshops were led by accomplished business leaders and entrepreneur support organizations and were well-attended; over 80 aspiring and current entrepreneurs participated. Workshops topics included How To Start A Business, Meet the Small Business Administration, Socialize Your Idea, Is Your Idea Sustainable?, and Storytelling for Entrepreneurs: Explaining your "Why". The participants’ workshop surveys revealed that the topics proved very relevant to the entrepreneurs in attendance. The majority of the participants reported that they could immediately apply what they learned.