For decades, efforts to close the racial wealth gap have focused on training, mentorship, and ecosystem-building—but too often, without real investment in Black entrepreneurs and the Black-led organizations that serve them. Through Black Wall Street Forward (BWSF), we’ve learned that if we want to create lasting economic change, we must rethink how we invest in Black entrepreneurship.

And this is not a future concern—it’s an urgent, time-sensitive call to action. With federal grant and loan programs that have provided equitable support for racialized entrepreneurs facing major rollbacks under the current administration, the role of philanthropy, private investors, and donor-advised funds (DAFs) has never been more critical. If we don’t act now, we risk erasing hard-fought progress and deepening racial wealth disparities.

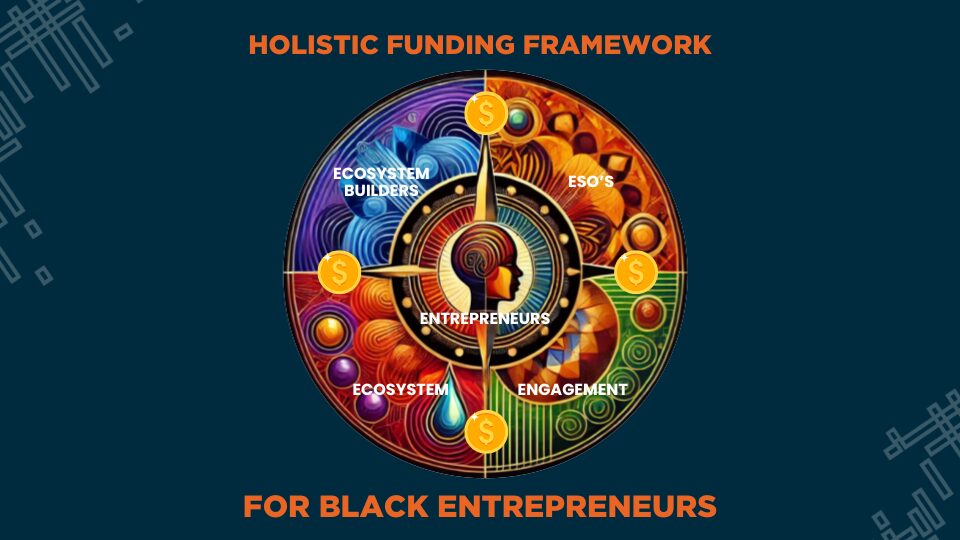

This article is the first in a series exploring a new, cohesive framework for funding Black entrepreneurship. Over the next several pieces, we will take a deeper dive into each of the five key shifts that must happen for funders to move beyond transactional support and toward a real investment model that drives sustainable change. But first, let’s set the stage with a high-level look at the framework:

"If we want to create lasting economic change, we must rethink how we invest in Black entrepreneurship."

Fay Horwitt

1. Prioritize Deep Relationship-Building – Because Trust Drives Growth

Every thriving economy is built on strong relationships, and Black entrepreneurship is no different. Yet, funders often focus on transactional support—grants, technical assistance, and networking—without recognizing that trust is the true foundation of an ecosystem. Black entrepreneurs and ecosystem builders don’t just need access to resources; they need trusted relationships that open doors, create collaborations, and fuel long-term success.

To build thriving Black economies, we must invest in relational infrastructure—through in-person convenings, small group gatherings, 1:1 mentorship, and curated partnerships. When Black entrepreneurs have spaces to exchange knowledge, form alliances, and build social capital, opportunities naturally follow. If we want scalable impact, we must first build trust.

In Part 2, we take a deeper dive into why relationship-building is the foundation of a thriving Black business ecosystem—and how funders can invest in it effectively.

2. Invest in People, Not Just Programs

Once trust is established, the next step is ensuring that the right people are empowered to lead. Black entrepreneurial ecosystems thrive when anchored by trusted, visionary leaders—the people who mobilize communities, cultivate collaboration, and advocate for policy changes. These leaders are often forced to do this work without proper financial backing, operating on personal passion instead of institutional support.

Rather than just funding short-term projects, we must invest directly in the people who drive them—providing competitive salaries, leadership development, and capacity-building support. Without investing in the individuals who hold ecosystems together, we cannot expect those ecosystems to sustain or scale.

Read installment 3 on why funding trusted ecosystem builders is a game-changer for Black entrepreneurial success.

3. Fund Black-Led Organizations Like You Mean It

Strong leaders alone aren’t enough—they need resourced organizations to carry out their work. Too often, Black-led organizations are forced to function on restricted, short-term grants that limit flexibility and hinder real innovation. Instead of trusting these organizations to allocate funds based on community needs, funders tie dollars to rigid programmatic deliverables that don’t reflect the realities on the ground.

If we are serious about equity, unrestricted, multi-year funding must become the standard. Black-led organizations deserve the ability to build long-term capacity, experiment, pivot, and grow. When we invest in the infrastructure of Black-led organizations, we strengthen entire communities.

Here, we tackle the urgent need for unrestricted, long-term funding and how it creates sustainable Black economies.

4. End the Scarcity Model – Fund Ecosystems, Not Just Individuals

With well-resourced leaders and organizations in place, we must move beyond isolated investments to support entire ecosystems. Right now, Black-led organizations are often forced into zero-sum competition for limited resources, pitting them against one another rather than fostering collaboration. This scarcity model weakens impact and reinforces silos instead of allowing collective power to flourish.

To change this, funders must think bigger—supporting networks, not just nodes. Investing in entrepreneurial ecosystems means funding multiple organizations within a region, creating shared resources, and enabling collaborative funding models that allow organizations to work together rather than fight for survival. A thriving Black economy isn’t built through one-off investments; it’s built through interconnected, long-term support structures.

5. Put Capital in the Hands of Black Entrepreneurs – Without Barriers

At the center of all of this are the entrepreneurs themselves. No matter how strong the relationships, leaders, and ecosystems are, if Black business owners don’t have direct access to capital, they remain stuck in survival mode.

It’s time to shift from funding around Black entrepreneurs to funding them directly. Instead of making Black founders jump through endless hoops to prove they’re worthy of investment, we need entrepreneur-first financing models—unrestricted grants, revenue-based funding, and community-driven capital that flows directly into Black-owned businesses. If we believe Black entrepreneurship is key to closing the racial wealth gap, we must stop forcing Black founders to navigate unnecessary barriers to funding.

Why This Matters Right Now

These shifts aren’t just theoretical—they are mission-critical at this moment in history. With growing political opposition to racial equity initiatives, federal support for Black entrepreneurs is at risk. Major grant and loan programs that have provided essential funding are being curbed and potentially rolled back altogether.

This is why philanthropy, private investors, and donor-advised funds (DAFs) must step up now. We cannot rely on public sector commitments that may disappear overnight. The responsibility falls on funders who truly believe in equitable wealth-building to fill this gap before it’s too late.

Where We Go From Here

This blog is just the beginning. Over the next several pieces, we’ll take a deep dive into each element of this new, cohesive funding framework—breaking down the strategies, examples, and real-world applications funders can use to move from transactional support to transformational investment.

If we truly want to close the racial wealth gap, we need to stop tinkering around the edges and start investing like we actually believe in Black entrepreneurs. The time for incremental change has passed—now is the moment to act boldly.

Will philanthropy, investors, and DAFs meet this moment?

If you’re ready to be part of a real investment revolution in Black entrepreneurship, let’s talk.

Stay connected with BWSF and follow this series as we break down exactly how to do it.

UP NEXT:

ABOUT THE AUTHOR

ABOUT THE AUTHOR

Fay Horwitt

Chief Program Officer, Forward Cities

Fay serves as the Chief Program Officer of Forward Cities, where she oversees organizational strategy. In addition, Fay is a dedicated advocate for the emerging profession of ecosystem building, and as a founding member of Ecosystems Unite. Beyond her formal roles, she is a sought after presenter, trainer, and thought leader on the topic of equitable entrepreneurial ecosystem building. Never one to be content with status quo, Fay has also recently begun addressing a new need in local communities: ecosystem healing–helping pivot ecosystems and institutions in this time of the dual COVID-19 and systemic racial injustice pandemics.

The Black Wall Street Forward initiative aims to reshape narratives, engage community leaders and entrepreneurs, and foster sustainable, equitably invested, Black-centric entrepreneurial communities.

Are you interested in learning more about Black Wall Street Forward or finding ways to join the movement? Subscribe to the newsletter to stay updated on what’s new and ways to engage with us.